Against the background of slowing global economic growth, China's PCB output value and its proportion have increased year by year, and gradually realized a surplus. From the perspective of product structure, China's exports are mainly low-end PCB products, while imports are mostly high-end PCB products, such as high multilayer boards, HDI boards, flexible boards and packaging. However, with the continuous enhancement of the strength of Chinese PCB enterprises, the product structure of PCB industry import and export has gradually changed.

Development status of electronic assembly industry

The connection of electronic assembly refers to the assembly and welding of passive components, active components, connectors and other electronic components on PCB through plug-in, surface mount, micro assembly and other methods according to the design scheme, so as to realize the interconnection between electronic and electrical, and form modules, complete machines or systems through functional and reliability tests, which belongs to the downstream link of PCB manufacturing business. The industry where Electronic Assembly is located is the EMS industry, which refers to the industry providing manufacturing services for various electronic products in a narrow sense, representing the outsourcing of manufacturing links. At present, the international leading EMS manufacturers can provide branded customers with a number of services other than brand sales, including electronic product design, engineering development, raw material procurement and management, manufacturing, testing and after-sales services.

1) Industry development status

The EMS industry was first started in Silicon Valley of the United States, and developed from Surface Mount Technology. With the continuous upgrading of electronic products, the continuous innovation of the EMS industry has gradually become an important part of the vertical division system of the global electronic industry. The EMS industry has been able to provide services covering the entire product life cycle from the initial manufacturing services for brand manufacturers to the present, covering various services from pre manufacturing product design and engineering development to the end of product life.

With the transfer of the global electronics manufacturing base to China, many EMS manufacturers have invested in the establishment of factories in China and set up operating organizations and manufacturing bases. At present, a relatively complete electronic industry cluster has been formed in the Yangtze River Delta, the Pearl River Delta and the Bohai Rim region in China. The upstream and downstream supporting industrial chains around consumer electronics, communication equipment, computers and network equipment have formed an industrial cluster effect.

On the one hand, a number of small and medium-sized EMS manufacturers, as well as component supporting manufacturers, characterized by contracts and outsourcing, have grown up around multinational electronic brand enterprises; On the other hand, while producing their own brand products, Chinese brands also use their own capacity to undertake outsourced electronic manufacturing services for multinational enterprises.

EMS mode has become an important part of China's electronic manufacturing industry. At present, major global EMS companies, including Foxconn, Flextronics, Jabil, Tianhong, New America, etc., have entered the Chinese market, taking China as an important part of their global industrial layout, which has brought new industrial cooperation models for the domestic EMS industry and created opportunities for domestic EMS manufacturers to enter the international market.

After years of development, the domestic leading EMS manufacturers have been familiar with and established a service mode of cooperation with international brand customers. The improvement of service concept has enabled these excellent local EMS companies to participate in international competition and begin to provide additional services covering product development, component procurement, warehousing, logistics, after-sales and so on.

2) Industry development trend

① The supply chain collaboration between brands and EMS manufacturers has been continuously consolidated and deepened. For end brands, in the context of rapid changes in electronic products, outsourcing some links of the product supply chain can effectively shorten the development and supply cycle of new products, improve production capacity and reduce production costs. They focus on brand management and sales channels, Quickly launch new products to consolidate its dominant position.

For EMS service providers, in the process of cooperation with brands in different sub sectors, their comprehensive strength has been continuously improved by increasing the scope of services, and gradually cut into each link of the brand's product supply chain, evolving from the initial circuit board mounting to comprehensive production, material procurement and supplier management, and moving forward to design, after-sales and other services. With the deepening of cooperation between the two sides at the supply chain level, the relationship between EMS service providers and brands has also developed from the initial "OEM" relationship into a long-term stable partnership.

From the perspective of the world's leading EMS service providers at present, the role of acting as the supply chain consultant of the brand has become increasingly prominent. After giving up the control of many links in the supply chain, the brand providers increasingly rely on EMS service providers with outstanding comprehensive strength to assist them in integrating supply chain resources and optimizing various processes of product supply.

EMS in the collaborative development stage mainly includes three aspects: pre manufacturing services, including participating in the market research, product development and early supply chain design of the brand; Services in manufacturing, including supply chain management, production and manufacturing management, etc; Post manufacturing services include customized distribution services, logistics distribution, after-sales maintenance and product recycling.

② The permeability of "EMS/ODM" still has the trend of continuous improvement

EMS/ODM penetration rate refers to the ratio of EMS/ODM sales revenue to the total cost of goods sold in the electronic manufacturing industry. It is an indicator used to measure the degree of outsourcing in the electronic industry. With the growing maturity of the electronic manufacturing service model and the continuous improvement of the comprehensive service capabilities of service providers, the global electronic manufacturing service industry is showing an increasingly wide range of service fields, and the total volume of OEM is showing an increasing trend of development year by year. It is expected that the penetration rate of the global electronic manufacturing service industry will still be further improved in the future.

③ The EMS service industry is diversified, and "small batch, multi variety" is becoming a trend

At present, the EMS service has shown a trend of multi industry development from the beginning of its development centered on the production and manufacturing of the computer field. For more and more small batch electronic product fields with insufficient economic scale, such as communication, industrial control, consumer electronics, medical electronics, automobile electronics, etc., even though the brand manufacturers can complete mass production, the EMS service providers can make the manufacturing more flexible and increase or decrease freely through their professional services, Timely meet the demand.

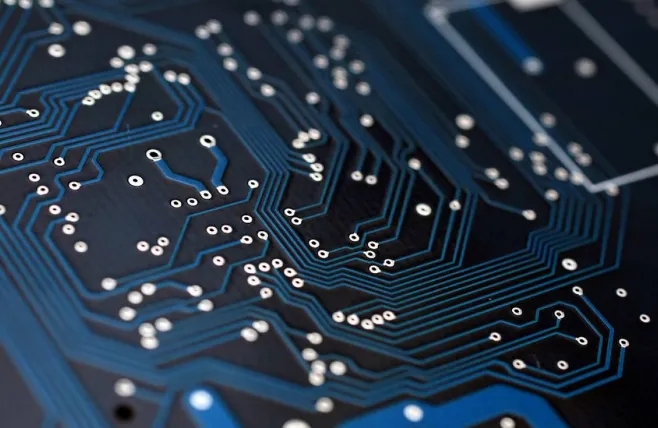

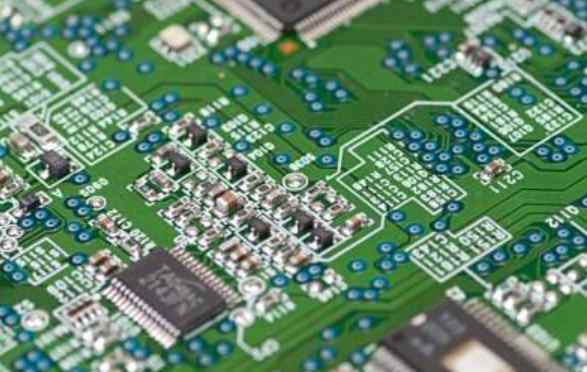

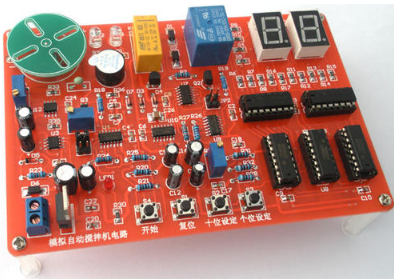

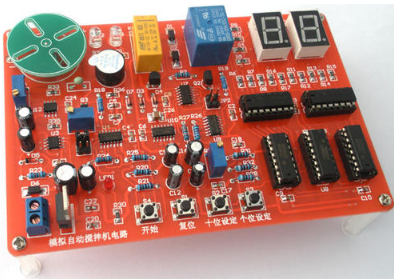

Circuit board

International market competition pattern of printed circuit board (including packaging substrate) industry

At present, there are about 2800 PCB enterprises in the world, mainly concentrated in six regions including Chinese Mainland, Taiwan, Japan, South Korea, the United States and Europe. From the perspective of industrial technology level, Japan is the largest high-end PCB production region in the world, and its products are mainly high-end HDI boards, packaging substrates, and high-level flexible boards; The United States has retained the R&D and production of highly complex PCBs. The products are mainly high-end multilayer boards, mainly used in military, aviation, communications and other fields; PCB enterprises in South Korea and Taiwan also focus on packaging substrates and HDI boards with high added value; Compared with the United States, Japan, South Korea and Taiwan, the overall technical level of products in Chinese Mainland has a certain gap. However, with the rapid expansion of industrial scale, the upgrading process of PCB industry in Chinese Mainland has been accelerating, and the production capacity of high-end multilayer boards, flexible boards, HDI boards and other products has been greatly improved.

1) Top 10 Manufacturers of printed circuit boards in the World

According to Prismark's statistics, the ranking of the world's top ten printers in 2016 is as follows:

Most of the top 30 PCB manufacturers in the world are oriented to personal consumption fields such as computers, mobile terminals and consumer electronics. Shennan Circuit ranks 21st in the world and is the only domestic enterprise among the top 30 manufacturers, mainly targeting enterprise level users in communication equipment, industrial control medical, aerospace and other fields.

2) Top 10 global manufacturers of packaging substrates

According to Prismark's statistics, the world's top ten packaging substrate manufacturers in 2016 ranked as follows:

Data source: Prismark 2017Q1 Note 1: The operating income in the above table only refers to the operating income of each enterprise's packaged substrate products; Note 2: Market share=2016 operating income ÷ 2016 global output value of packaging substrate industry.

It can be seen from the above table that at present, the global packaging substrate industry is basically monopolized by PCB enterprises in Japan, South Korea and Taiwan, such as UMTC, Ibiden, SEMCO, etc. The market share of the world's top ten packaging substrate manufacturers is as high as 81.98%, and the industry concentration is high.

The huge development space of China's PCB market has attracted a large number of international enterprises. Most of the world famous PCB manufacturers have established production bases in China and actively expanded. At present, there are about 1500 PCB enterprises in China, forming a pattern of mutual competition among Taiwan funded, Hong Kong funded, US funded, Japanese funded and local domestic funded enterprises. Among them, foreign-funded enterprises generally have large investment scale and certain advantages in production technology and product specialization; There are a large number of domestic enterprises, but there is still a gap between the scale and technical level of enterprises and foreign enterprises.

According to the ranking list of China's printed circuit industry released by CPCA, the ranking of China's top ten PCB manufacturers in 2016 is as follows:

Competition pattern of electronic assembly industry

In recent years, the global electronic component manufacturing industry has developed rapidly, and the technical level has also continued to improve. Efficient output and continuously reduced costs provide a strong guarantee for the vigorous development of the electronic manufacturing industry. These factors are not only conducive to the diversification and personalization of electronic products, but also conducive to driving down the overall price of electronic products, making the market demand for downstream products continue to grow, laying a solid foundation for the development of electronic manufacturing services.

According to the data of New Venture Research disclosed by the International Association for the Connection of Electronic Industries (IPC), the global revenue of electronic contract manufacturing services reached 430.1 billion dollars in 2015 and 446.3 billion dollars in 2016. It is estimated that the global revenue of electronic manufacturing services will reach more than 559.8 billion dollars in 2020, with an average annual growth rate of 5.4% from 2015 to 2020.

According to the report disclosed by MMI, the comprehensive operating income of the global EMS business in 2015 was about 285.5 billion US dollars, an increase of 0.9% over 2014. The top 25 suppliers in the world accounted for 75.5% of the market share, slightly higher than the 73.4% year-on-year share in 2014, and the market concentration was high. From the perspective of revenue composition, consumer electronics and communication products are the main sources of comprehensive operating revenue of major EMS manufacturers, accounting for 48.5% in total, computer and storage businesses accounting for 29.8% in total, industrial and commercial, medical, automotive, national defense, security, aerospace and other non-traditional sectors accounting for 15.3% in total, and basic communication equipment accounting for 6.4%. From the perspective of growth rate, the sales of consumer electronics and mobile phones have the highest growth rate, with a year-on-year growth of 1244%. In 2015, Foxconn's new sales in these two fields reached up to 60 billion dollars. The rise of this field is closely related to the continued strong demand of China and other developing countries. In addition, the sales of computer and storage businesses have grown steadily, and the infrastructure construction of cloud computing has become the key to support their sustained growth. The performance of basic communication equipment and non-traditional departments is temporarily less significant than that of traditional departments. Since 2016, the global purchasing managers' index (PMI) has warmed up in an all-round way. After regional and seasonal adjustments, it is expected that the business volume of various EMS sectors will continue to grow in 2017.

With the rapid development of global electronic technology, various products emerge one after another, and the shorter and shorter product upgrading cycle has brought huge market demand to the industry. In the next few years, the global electronic product industry will still maintain a rapid growth, which will directly lead to the increase of EMS business volume and effectively promote the development of the EMS industry.

In addition, in order to cope with the PCB market competition, improve the overall competitiveness of the supply chain, constantly expand the proportion of outsourcing services in all links of the supply chain, many brands focus their own development on responding to market demand, adjusting product structure and operating brands, which also provides a broad space for the development of EMS companies.